Sparkasse Ihre mobile Filiale

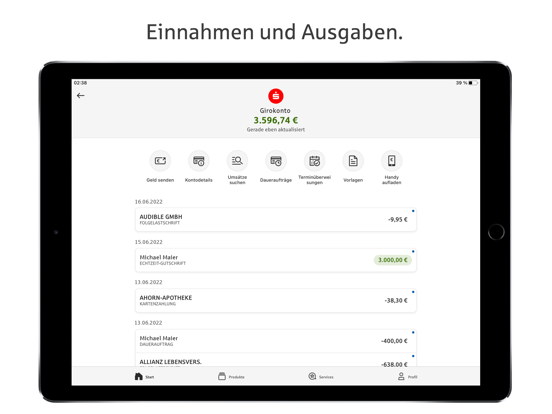

Banking without opening hours, transfers from your couch and account transactions always in view: Use simple and intuitive banking and take care of your banking transactions on the side.

ADVANTAGES

• Check your accounts anytime and anywhere

• Manage any number of online accounts - from Sparkassen and other banks

• quickly set up transfers and standing orders, return direct debits

• Stay informed about all account movements with the account alarm clock

• find the shortest route to the nearest ATM or branch

• graphical representation via financial planner in the app

The Sparkasse app is there for you in all situations. Whether youre setting up a standing order on the train, paying your bill at the breakfast table with a photo transfer or checking your account balance and credit card transactions. No more tedious filling out a transfer slip on the computer. Instead, you can simply do everything with your iPhone/iPad.

ACCOUNT ALARM

The account alarm clock informs you promptly about account movements around the clock. If you want to know whats going on in your account every day, set up the account balance alarm clock. The salary alarm clock tells you when your salary arrives and the limit alarm clock lets you know whether your account balance has been exceeded or fallen short of.

FROM MOBILE TO MOBLIE

Splitting a bill after a pleasant evening with friends in a restaurant is very easy. With giropay | Kwitt and wero, you can send money from cell phone to cell phone without delay. It also works for borrowing money or collecting money together for a gift.

APPLE PAY

Apple Pay is of course included, and the Sparkasse app is a prerequisite for this. You use it to activate your digital cards for the Wallet app.

HIGH SECURITY

You dont have to worry about mobile banking as long as you use a high-quality, state-of-the-art banking app in conjunction with an up-to-date operating system and a secure internet connection. The Sparkasse app communicates via tested interfaces and ensures secure data transfer in accordance with German online banking regulations. All data is stored in encrypted form. Access is protected by a password and optionally by Touch ID/Face ID. The autolock function locks the app automatically. All finances are protected to the maximum in the event of loss. TÜV confirms the security standards and reviews them annually.

PRACTICAL FUNCTIONS

Use the search function to find transactions across accounts and bank details. Set up a budget book (offline account) for budget planning and view graphical evaluations with your savings banks financial planner. You have a direct line to your savings bank via the app and access to many services such as card blocking, messages, reminders, appointments and even account opening via the app (if offered by your Sparkasse). On top of that, you can switch directly to the S-Invest app and carry out your securities transactions.

PREREQUISITES

You need an account with a German savings bank/bank that is activated for online banking. The TAN procedures supported for payment transactions are chipTAN manual, chipTAN QR, chipTAN comfort (optical), pushTAN; smsTAN.

NOTES

Questions and comments can be sent directly from the app via the small question mark bubble at the top right. Individual functions may incur costs at your bank, which may be passed on to you. giropay | Kwitt and wero are available if they are supported by your Sparkasse.

By downloading and/or using the Sparkasse app, you accept the terms and conditions of the end user license agreement of Star Finanz GmbH without restriction. The protection of your data is regulated in the privacy policy.

• Data protection: https://cdn.starfinanz.de/index.php?id=datenschutz_ios_sparkasse_en

• Terms of use: https://cdn.starfinanz.de/index.php?id=lizenz-ios